Get our newsletter

Life is unpredictable, and it's essential to be prepared for all eventualities, including the end of your own life. Failing to plan ahead can have devastating consequences for you and your loved ones.

Get our tips now

I would like to access detailed information on death formalities.

Life is unpredictable, and it's essential to be prepared for all eventualities, including the end of your own life. Failing to plan ahead can have devastating consequences for you and your loved ones.

Get our tips now

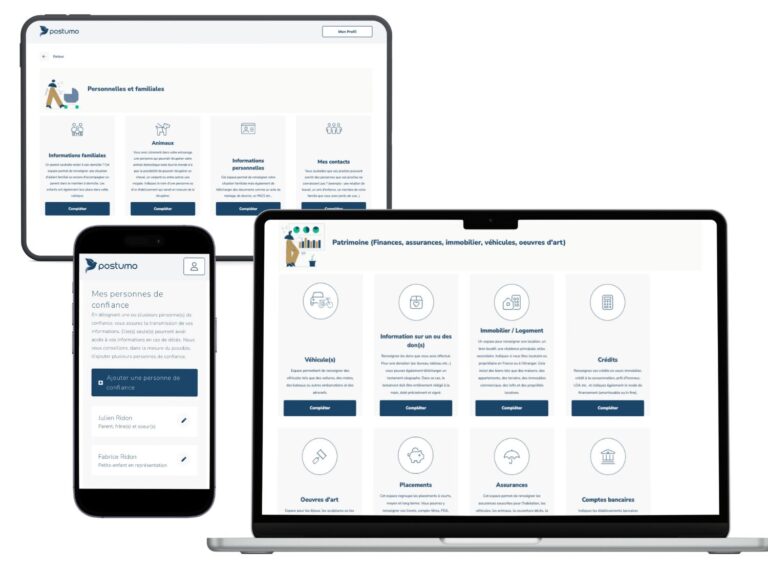

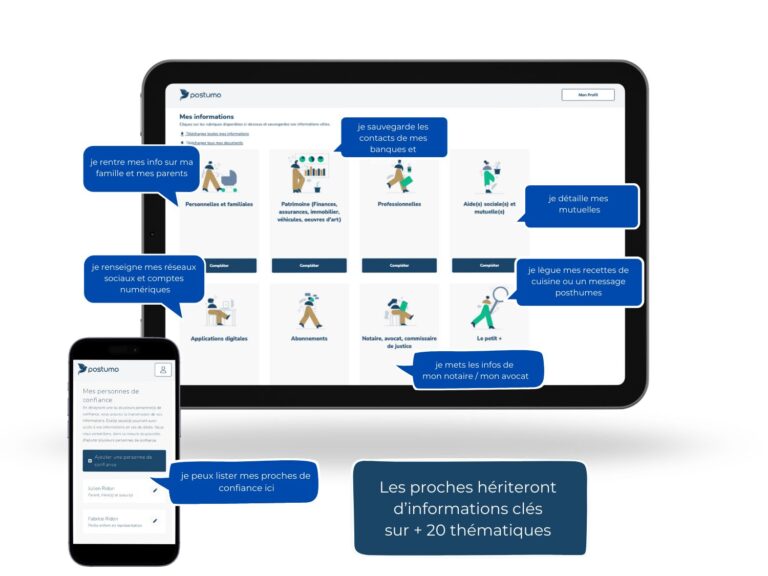

Sauvegardez vos données de vie pour en simplifier la transmission et faciliter les démarches décès.

You are about 25 000 of you to visit our website each month, thank you !

Reliable protection for your most important information, its transfer to the family to help simplify all posthumous formalities.

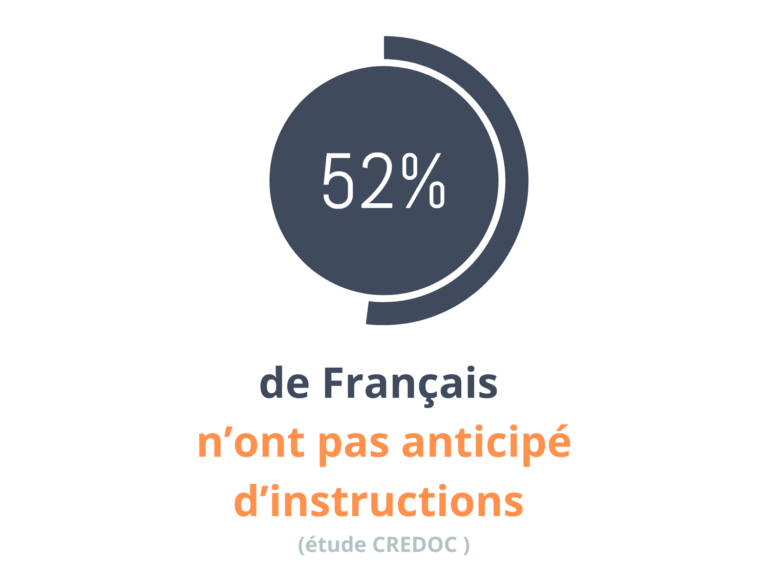

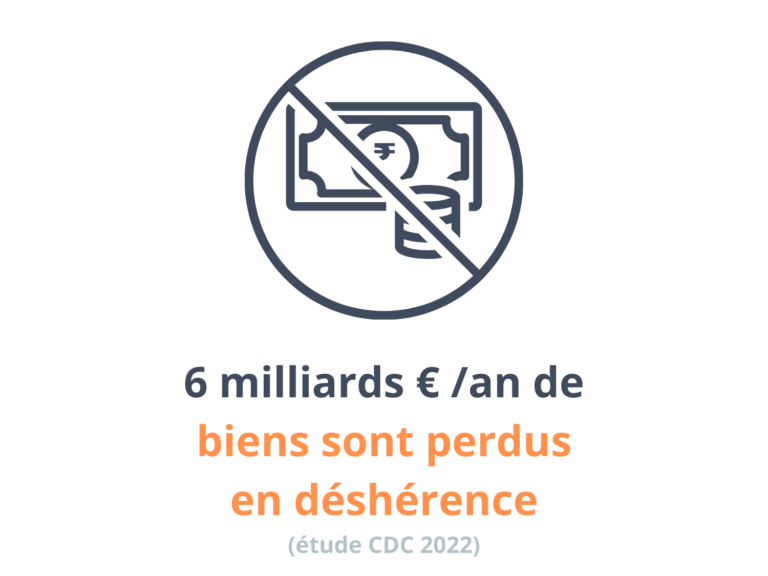

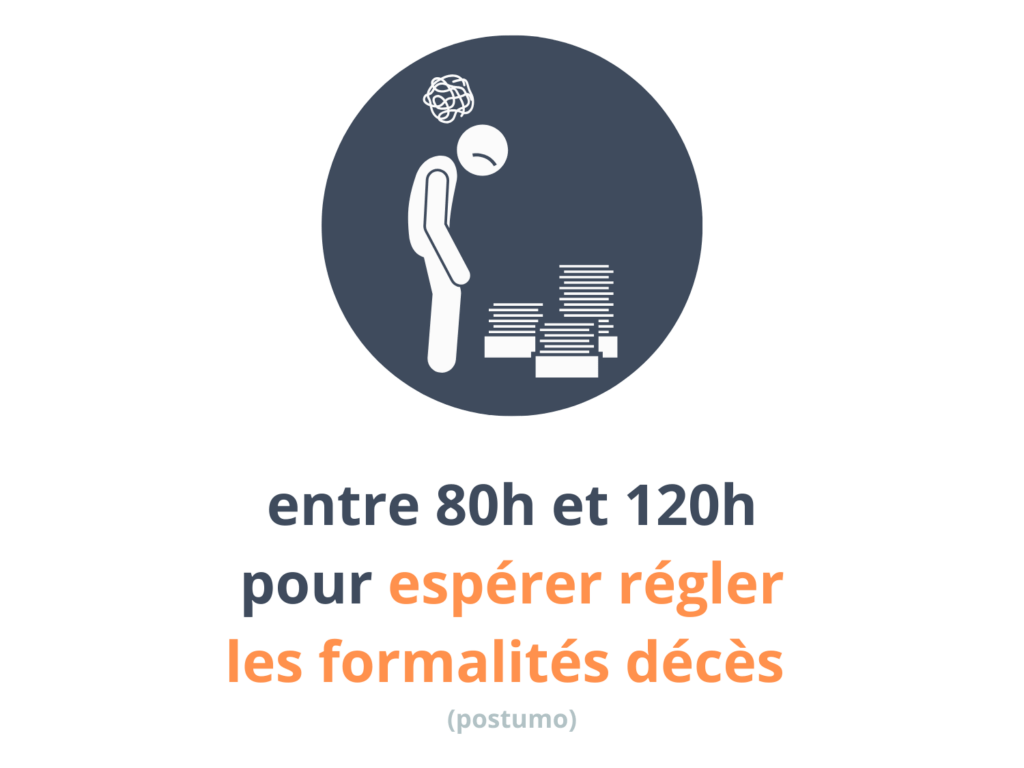

The scattering of our personal information complicates life for our loved ones in the event of death, serious illness, degenerative conditions like Alzheimer’s, or accidents. Without prior organization, the family faces heavy, complex, and stressful administrative tasks, along with the risk of unclaimed assets.

So we understand that protecting your personal information is a top priority for your loved ones to inherit. That's why Postumo is designed to store essential documents and personal details that help your loved ones manage your affairs, without containing content. sensitive information such as passwords, bank balances or asset values. Your security and peace of mind are important to Postumo, and we're here to provide you with the tools you need to plan effectively, while keeping your financial information secure elsewhere.

We are taking security matters very seriously.

The security of your personal information is our top priority. We understand the importance of protecting your inventory without ever compromising your data.

Just like banking institutions, we use advanced encryption technologies to protect your information. Your data is as secure with us as it is with your bank.

At Postumo, your data inventory remains confidential, and our service team does not have access to it.

Our platform allows you to record all your important information and ensures secure transmission in case of need.

With Postumo, you can create an exhaustive inventory of all your accounts and digital assets, offering simplified access to your loved ones or delegates in case of need, while maintaining the integrity and security of your data.

An advanced encryption protocol (AES256) is used by Postumo This is the encryption algorithm currently in use, widely deployed in government and military applications, as well as by companies in highly regulated industries. This means that the data on our services is strictly unreadable to hackers.

Multi-factor authentication (MFA) is an authentication method in which the user must provide at least two verification factors to access the Postumo application.

They share their experience

Postumo was born from the experiences of two brothers, Julien and Franck Ridon, following the loss of their close parents, a grandmother and then an aunt. Faced with the complexity of administrative procedures, financial complications, avoid family tensions, and the unclaimed assets and money, they realized that the lack of up-to-date information about a person was the main problem. They also understood the importance of taking into account each person’s unique life journey to correctly carry out posthumous formalities.

They therefore developed a simple and super secure digital solution to help families overcome these difficulties.

Postumo is actually complementary to the will

The will is designed to list assets for inheritance and outline final wishes. It does not provide finer details about an asset. That's why this Postumo service was created to complement the will, by securing relevant information that the family can pass on to the notary.

In the event of death, Postumo allows to transmit immediately the data to the family members so they can immediately start the first posthumous formalities while waiting for the appointment with a notary.

Finally, not all personal properties are necessarily recorded in the will: jewelry, a watch, paintings, etc.

The notary identifies the heirs and contacts the various organizations with which the deceased was affiliated, as well as the establishments of which he was a client, with the sole aim of obtaining certain information or documents in order to draw up a complete balance sheet of his assets and thus be able to liquidate the estate.

He draws up the deeds required by the heirs (deed of notoriety, property certificate, etc.), carries out the mortgage and tax formalities linked to the death and, if necessary, divides up the assets.

However, it is up to the deceased's family to inform the various organizations of the death (employer, pension funds, social organizations, banks, service providers, etc.).

Finally, for other formalities, the heir can, thanks to the deeds drawn up by the notary, intervene in contracts or services linked to organizations (unblocking a bank account, intervening in the registration certificate of a motor vehicle, etc.).

Based on this principle, the role of surviving spouses, families, beneficiaries and even heirs is essential, as they must "legally" take care of the initial steps and all future formalities.

It's important to understand that time is of the essence here. Every month, pensions, rents, grants and expenses accumulate and will add to the deceased's debts in the estate.

This way, the Postumo solution complements the notary's work and avoids duplication.

Preparing the recording of your information before illness (Alzheimer’s) or death is important.

It's natural to put off thinking about planning for the future, especially when it comes to such delicate matters as providing for your family after your death. However, recognizing the importance of doing so is crucial to ensuring financial, emotional, and practical stability for your loved ones in difficult times. Although the thought of mortality can be uncomfortable, prudence and foresight will help ease the burden that will fall on your loved ones.

1. Financial protection: Planning provides financial security for your loved ones by ensuring that the necessary resources are available to cover unavoidable expenses such as funerals, debts, or legal fees. Ignoring this can leave your loved ones facing considerable financial difficulties.

2. Preserving emotional well-being: The loss of a loved one is already an extremely difficult emotional ordeal. By making preventive decisions, you can offer your loved ones peace of mind, sparing them additional financial and administrative worries during an already difficult period.

3. Ensuring your wishes are respected: planning allows you to clearly express your wishes regarding your inheritance, child custody, funeral arrangements and so on. This ensures that your wishes are respected, and reduces the risk of family conflicts that could arise in the absence of explicit directives.

4. Avoid legal complications: Failure to plan ahead can lead to legal complications, family conflicts and delays in the distribution of assets. By being proactive, you simplify the estate process, reducing the stress and challenges your loved ones may face.

5. Responsibility to the family: By taking preventive measures, you demonstrate your responsibility to your family, and show your love and concern for them. Advance planning is an act of affection that can strengthen family ties by showing that you've taken steps to protect them, even in your absence.

Although planning for the afterlife may seem daunting, it's a crucial step in ensuring the well-being of your loved ones. By addressing these delicate aspects now, you're helping to create stable conditions for those you cherish most.

C’est sa capacité à servir à la fois d’outil de prévoyance des informations de son vivant et de la préparation aux formalités de décès. Cette caractéristique distingue clairement Postumo des autres solutions qui sont généralement limitées à l’un ou l’autre aspect, ou qui ne couvrent pas du tout ces besoins spécifiques.

This dual functionality highlights the added value of Postumo as a comprehensive solution for managing important personal information throughout life and beyond, providing unique peace of mind to users.

Des services alternatifs existent pour vous aider dans cette période délicate après le décès d’un proche. Ces services disponibles n’offrent que des prestations partielles.

– Le coffre-fort numérique est principalement destiné aux employés d’entreprises pour le stockage sécurisé des informations professionnelles.

– Certaines solutions de stockage payantes existent mais ces fournisseurs ne proposent que de stocker leurs comptes numériques et les comptes crypto-monnaies. C’est un bon début mais il manque beaucoup plus d’informations et la possibilité de simplifier les formalités décès.

– Les clouds publics gratuits comme Google Drive, OneDrive et Dropbox sont utilisés par les particuliers pour le stockage et le partage de fichiers. Principalement conçus pour des documents, et non pas de l’information, la transmission aux proches n’est pas une priorité. Ces services en ligne de stockage gratuits ne sont pas conçus pour garantir la transmission immédiate aux proches et ne cryptent pas les données systématiquement. Ils offrent des niveaux de sécurité avancés pour les entreprises, mais pas pour les particuliers. Les risques cyber existent pour les particuliers. Le risque existe.

– Concernant les services de formalités décès, certains opérateurs proposent des assistances. Ils proposent notamment des exemples de courriers décès mais sans expliquer lesquels les concernent. et leur support se limite à 6 mois.

– Enfin le petit classeur de nos aînés est devenu dépassé à l’heure du numérique.

In France, there are three main categories of administrative formalities required following the death of a loved one:

1. Funeral formalities :

– Declaration of death : The first step is to obtain a medical certificate of death issued by a doctor. This certificate must then be presented to the town hall for the official declaration of death.

– Choosing a funeral home Funeral arrangements: The next of kin must choose a mortician who will take charge of organizing the funeral. This includes choice of coffin, preparation of the body, ceremony, committal, and burial or cremation.

– Request for burial or cremation authorization Funeral services: Funeral directors are also responsible for requesting authorization for burial or cremation from the town hall of the place of death.

2. Property succession formalities :

– Appointment with the notary : Heirs must make an appointment with a notary. The notary plays an essential role in the settlement of the estate.

– Inventory of assets and liabilities The notary will draw up an inventory of the deceased's assets and debts. He will take into account real estate, bank accounts, life insurance policies, furniture, etc.

– Determining heirs and sharing assets The notary will help determine the legal heirs, establish the rights of each and proceed with the division of assets in accordance with legal provisions or the eventual will.

3. Formalities related to the notification of the administrations and organizations involved:

– Notification of death to social security The next of kin must inform Social Security of the death of the deceased in order to terminate all rights and benefits.

– Notification to financial institutions Banks, insurance companies and other financial institutions must be informed of the death in order to freeze the accounts and take the necessary steps.

– Notification to public and private bodies Other organizations such as pension funds, employers, mutual insurance companies, etc. must also be notified.

– Contract and subscription management Cancellation of the deceased's contracts and subscriptions, such as electricity, gas, Internet, etc.

It is important to stress that the notary can play a central role in assisting with these procedures, by providing legal advice and ensuring that the succession formalities run smoothly. Relatives can also enlist the help of a specialist like Postumo to guide them through these often complex procedures.

We all have different life paths, and as such, each approach needs to be adapted.

We work (or have worked) in different professional sectors, our families are different, some single-parent, others blended, some with dependent parents.

Real estate and personal property situations require different formalities.

Everyone must notify their insurance companies and banks in France and abroad... etc.

Postumo is specially designed to help families with administrative procedures.

They are tedious and emotionally taxing, and inevitably follow a death.

Yes. There are numerous steps to take, and according to a precise timetable.

To help you understand the steps involved, we've listed them in "chronological" order.

Attention : Une précision qui mérite d’être abordée: Chaque démarche est unique. Votre situation personnelle n’est pas celle de votre voisin.

You will need :

Within 24 hours of death

Within 48 hours

During the month, you should also contact :

Within 4 months :

Within 6 months

What's next?

Unfortunately, the process doesn't stop there.

In many cases, the successor in title forgets about themselves when it comes to the formalities following the declaration of inheritance. This is often because they have been under pressure for a long time to regularize current affairs, and have made repeated reminders. It can also simply be a case of mourning. You want to turn the page and move on with your life.

It's easy to forget that, in certain cases, you can benefit from social assistance. To qualify, you need to provide proof of marital status, family situation and tax status. Unfortunately, the tax notice for the year of death does not reflect the loss of income you are (in some cases) suffering.

It's important, even essential, to deal with the formalities and meet certain deadlines. These include funeral arrangements and estate settlement, whether or not you wish to accept the estate.

Here are some important formalities for which the deadline is important:

Where can I find the deceased's administrative information?

In France, it's a complicated, yet necessary step, which involves searching for certain information in the deceased's personal belongings.

If the latter was organized, you'll be able to retrieve some of the information. If this is not the case, you may be able to find certain information on the account statements, in particular anything concerning direct debits from organizations, associations, suppliers, etc.

Finally, if you can't find the bank's information, you'll need to contact the FICOBA file, which will in turn contact the financial institutions as part of a search. For insurance contracts, this will be AGIRA.

Supporting documents to be prepared

For each request, you will need to submit supporting documents. Sending a simple letter will not suffice. Your request will not be processed, and you will have to contact the organization again.

What you'll need:

Finally, the notary may ask you to provide additional information, such as donations, judgments, property appraisals and company documents (articles of association, minutes of general meetings, etc.).

What is a CERFA form in France?

The term CERFA used to designate a public body (Centre d'enregistrement et de révision des formulaires administratifs). Today, the term refers to an administrative document that acts as a link between a request and the administration.

CERFA forms are numerous, as they concern a wide range of administrative services. These documents provide the administration with the information it needs to process the request.

If you'd like to apply for a death benefit, sell a vehicle, declare the loss of an identity card or declare an inheritance, you'll need to complete a CERFA form and attach it to your application, otherwise the authorities won't be able to take it into account.

Where can I find the right form?

There are several ways to find a CERFA. First, you can request it from the relevant administration. Note that with digitization, CERFAs are now available online. You can find them on service-public.fr by entering either the form number or the word CERFA along with the name of the form you are looking for.

How do I fill in the information on the CERFA form?

The information requested by the authorities on CERFA forms requires your full attention. Errors can lead to problems, particularly with tax documents.

To help you with your application, the forms are usually accompanied by instructions. If this is not the case, you'll need to look for the CERFA notice concerned, as it is not always attached to the form.

Following a death, a doctor draws up a death certificate. This certificate enables the town hall in the place of death or residence of the deceased to draw up an act of death.

This act of death is essential for the many formalities that will follow your death. Insurers, banks, suppliers, tax authorities, social security, pension funds, employers, landlords... will all ask for it. You'll need lots of copies to be able to modify or cancel contracts, block accounts and unblock insurance policies.

As you can see, this document is a must.

Ask for several originals and certified copies.

How do I obtain an act of death?

Anyone can request an act of death. You don't have to be a member of the family.

Death occurred in France

To obtain this document, you can request it in person at the town hall of the place of death, or at the town hall of the deceased's last domicile.

If you go to the counter, they will be able to issue it immediately.

You can also choose to online application on the following link: www.service-public.fr

You can also request it by post from the relevant town hall.

Death occurred abroad

When the death occurs abroad, contact the Ministry of Europe and Foreign Affairs, the embassy or consulate, so that they can contact the appropriate authorities in the country concerned. The act will then be drawn up by the local civil registry before being transcribed by the French civil registry.

To request an act of death, contact the Service Central de l'État Civil of the Ministry of Europe and Foreign Affairs 11, rue de la Maison-Blanche - 44941 Nantes Cedex 9.

You can also apply online here: online application to the Service central d'état civil

This is a long process, and you'll need to be patient.

Death of a foreigner in France

As in the case of the death of a French resident in France, you should contact the Mairie, which will draw up the death certificate.

Postumo is featured in all your favorite newspapers and magazines.

contact@postumo.fr

Between 8 a.m. and 7 p.m. Monday to Saturday

At this difficult time, our team is at your disposal to answer your questions and help you find answers to the administrative formalities following your death. Please do not hesitate to contact us.

Nous ne faisons pas de pub sur notre site en utilisant les données utilisateurs.

Les cookies nous servent juste à mieux comprendre les articles consultés par notre audience et lui proposer une expérience optimale. Vous pouvez accepter les cookies ou réguler leur utilisation depuis ce menu.

Postumo

postumo.fr

September 7, 2024

Compliance status

We firmly believe that the Internet should be available and accessible to everyone, and we are committed to providing a website that is accessible to the widest possible audience, whatever their circumstances and abilities.

To this end, we aim to comply as far as possible with the World Wide Web Consortium's (W3C) Web Content Accessibility Guidelines 2.1 (WCAG 2.1) at AA level. These guidelines explain how to make web content accessible to people with a wide range of disabilities. Compliance with these guidelines helps us to ensure that the website is accessible to all: blind people, people with motor impairments, visual impairments, cognitive impairments, and more.

This website uses various technologies to make it as accessible as possible at all times. We use an accessibility interface that enables people with specific disabilities to adjust the website's user interface (UI) and design it to suit their personal needs.

In addition, the website uses an AI-based application that runs in the background and constantly optimizes its level of accessibility. This application corrects the website's HTML, adapting its functionality and behavior for screen readers used by blind users, and for keyboard functions used by people with motor impairments.

If you've found a malfunction or have ideas for improvement, we'd love to hear from you. You can contact the website operators using the following e-mail address: contact@postumo.fr

Our website implements the ARIA (Accessible Rich Internet Applications) attribute technique, in addition to various behavioral changes, to ensure that blind users who visit the site with a screen reader can read, understand and enjoy the website's functions. As soon as a user with a screen reader enters your site, they are immediately prompted to enter the screen reader profile so they can navigate and use your site effectively. Here's how our website covers some of the most important requirements for screen readers, accompanied by screenshots of console code:

Optimization for screen readers: we run a background process that learns website components from top to bottom, to ensure continued compliance even when the website is updated. In this process, we provide screen readers with meaningful data using the ARIA attribute set. For example, we provide precise form labels; descriptions for actionable icons (social media icons, search icons, shopping cart icons, etc.); validation hints for form entries; roles for elements such as buttons, menus, modal dialogs (popups), and more. In addition, the background process scans all images on the website and provides an accurate and meaningful description based on object recognition as an ALT tag (alternative text) for images that are not described. It also extracts text embedded in the image, using OCR (optical character recognition) technology. To activate screen reader adjustments at any time, users simply press the Alt+1 key combination. Screen reader users also receive automatic announcements to activate screen reader mode as soon as they enter the website.

These adjustments are compatible with all popular screen readers, including JAWS and NVDA.

Keyboard navigation optimization: the background process also adjusts the website's HTML and adds various behaviors using JavaScript code to make the website keyboard-friendly. This includes the ability to navigate the website using the Tab and Shift+Tab keys, to operate drop-down menus using the arrow keys, to close them using Esc, to trigger buttons and links using the Enter key, to navigate between radio items and checkboxes using the arrow keys, and to fill them in using the spacebar or Enter key. In addition, keyboard users will find quick navigation menus and content skip menus, available at any time by clicking Alt+1, or as the first elements of the site when navigating with the keyboard. The background process also handles triggered popups by moving the keyboard focus towards them as soon as they appear, and does not allow the focus to drift away from them.

Users can also use shortcuts such as "M" (menus), "H" (titles), "F" (forms), "B" (buttons) and "G" (graphics) to jump to specific elements.

Epilepsy-safe mode: this profile enables people with epilepsy to use the site in complete safety, eliminating the risk of seizures caused by flashing animations or dangerous color combinations.

Visually impaired mode: this mode adjusts the site for the comfort of users with visual disorders such as impaired vision, reduced visual field, cataracts, glaucoma, etc.

Cognitive impairment mode: this mode offers various assistance options to help users with cognitive impairments such as dyslexia, autism, stroke and others to concentrate more easily on the essential elements of the site.

Hyperactivity-friendly mode (ADHD): this mode helps users with ADHD and neurodevelopmental disorders to read, navigate and concentrate more easily on the main elements of the site, while considerably reducing distractions.

Blind mode: this mode configures the site to be compatible with screen readers such as JAWS, NVDA, VoiceOver and TalkBack. A screen reader is software for blind users installed on computers and smartphones, and websites must be compatible with this software.

Keyboard navigation profile (people with reduced mobility): this profile enables people with reduced mobility to use the site using the Tab, Shift+Tab, and Enter keys. Users can also use shortcuts such as "M" (menus), "H" (titles), "F" (forms), "B" (buttons), and "G" (graphics) to jump to specific elements.

Font adjustments: users can increase and decrease font size, change font family (type), adjust spacing, alignment, line spacing and more.

Color adjustments: users can choose different color contrast profiles such as light, dark, inverted and monochrome. In addition, users can swap color schemes for titles, text and backgrounds, with over 7 different coloring options.

Animations: epileptic users can stop all animations in progress with a single click. Interface-controlled animations include videos, GIFs and flashing CSS transitions.

Content highlighting: users can choose to highlight important elements such as links and titles. They can also choose to highlight only those elements on which the pointer is placed or which are in focus.

Mute audio: users with hearing aids may experience headaches or other problems due to automatic audio playback. This option allows users to mute the entire site instantly.

Cognitive disorders: we use a search engine linked to Wikipedia and Wiktionary, enabling people with cognitive disorders to decipher the meanings of phrases, initials, slang and more.

Additional functions: we offer users the option of changing cursor color and size, using a print mode, activating a virtual keyboard, and many other functions.

Browser and assistive technology compatibility

We aim to support the widest possible range of browsers and assistive technologies, so that our users can choose the tools best suited to their needs, with as few limitations as possible. As a result, we've worked very hard to support all the major systems that account for over 95% of user market share, including Google Chrome, Mozilla Firefox, Apple Safari, Opera and Microsoft Edge, JAWS and NVDA (screen readers), for both Windows and MAC users.

Despite all our efforts to enable everyone to adjust the site to their needs, there may still be pages or sections that are not fully accessible, that are in the process of becoming so, or that lack an adequate technological solution to make them accessible. Nevertheless, we are continually improving our accessibility, adding, updating and enhancing options and features, and developing and adopting new technologies. All this is aimed at achieving the optimum level of accessibility, keeping pace with technological advances. For assistance, please contact contact@postumo.fr